From Hillwood Road, Tsim Sha Tsui to Fisherman’s Wharf, San Francisco,the remarkable entrepreneurial story of Philip Morais

- Oct 21, 2025

- 7 min read

Updated: Oct 28, 2025

By Anthony Correa

Born Filipe Pinto de Morais on 8 August 1947 in Hong Kong, “Philip” Morais as he was to become, is

undoubtedly one of the Hong Kong Portuguese Community’s most successful entrepreneurs.

The middle child and only son of 3, he grew up in Hillwood Road, amongst the other Portuguese families that had returned to that area of Kowloon after World War II. He attended La Salle College and graduated to attend Technical College (later Hong Kong Polytechnic) studying engineering. Like many Portuguese boys of that era he was offered a position at HSBC by Archer Larcina who was then chief clerk. He did not enjoy the rigid environment of HSBC and left after only 2 months, to join a Canadian -Swiss investment firm International Overseas Services (IOS) that ultimately collapsed in 1970.

Deciding not to return to the corporate world, Philip struck out on his own and formed his own real estate agency in Clearwater Bay selling and leasing properties.

In 1972 he married Eileen Collins and shortly thereafter he made his first real estate investment at the age of 25.

He had been renting a property for his new family in Shouson Hill and offered to buy it from his landlord for HK$350,000. However, as he did not have a deposit, asked for a 12 month deferred payment schedule that would allow his rental of $6,000 per month to be applied against the purchase price as a deposit, securing a mortgage for the balance. He then sold the house 2 years later for $650,000 – his first profitable real estate deal.

It was an enormous amount of money for a 27 year old and allowed him to start to take equity positions in real estate projects. Travelling to the Philippines for a softball tournament he met Joey Antonio, an aspiring developer (and now Philippines Ambassador at Large) and invested in three successful residential buildings and one commercial building. He started to travel the region and made an investment in Singapore. He then met Stanley Ho and travelled with him to Thailand and Kuala Lumpar where they made some joint investments with another partner Paul King, a Hong Kong solicitor. He and Stanley Ho made another investment in a building in Macau.

Throughout the 70s he continued with his real estate agency, employing a small team doing deals across Hong Kong. One his most memorable was securing the lease for one of Hong Kong’s most famous nightclubs Disco Dicso, opened in 1978 by Gordon Huthart the son of Lane Crawford CEORobert Huthart. Disco Disco, inspired by New York’s Studio 54, became a huge hit with both the local and expat community and sparked the growth of the nascent Lan Kwai Fong entertainment district.

Throughout these youthful and early adult years, Philip loved baseball and played softball. Hi younger years were inspired by Portuguese men’s and women’s softball teams such as the Braves, Jaguars, Cheyenne, Squaws, Seminoles, Madcaps and Club de Recreio itself. They were ably led by the likes of his uncle Vic Pedruco, Frankie Correa , Eduardo “Chief” Carvalho, Chappy Remedios, Calau Yvanovich, Calau Azevedo, Johnny Pereira and Dickie Alves all of whom young Philip looked up to and admired. In the 1963-64 softball league, such was the strength of their teams, that the Portuguese men at Club de Recreio swept the Senior, B and C leagues.

His own softball team was the “Amigos” and Philip’s teammates were fellow Portuguese from Lasalle College, Carlos Sousa, Moti Dayaram, Danny Dayaram, Joey Noronha, Mike Sousa, Jose Barros and Leo Barros. These halcyon days were to inspire Philip to undertake his most daring investment in 1992.

By the late 1980s, Philip was a well-established real estate investor in Hong Kong and the Asia Pacific region with a series of successful investments and a reputation as an entrepreneur. He was even able to assist Stanley Ho to retrieve a deposit he had paid for a new casino in Manila that had been frozen after the Ferdinand Marcos military coup.

His family was well established with three children Phil jnr (Born 1972), Patrick (1980) and Pilar (1982) all born in the United States. He had homes in Braga Circuit, Ho Man Tin, Manila and San Francisco and was open to new challenges. Still in his early 40s he began looking further afield, especially the United States where his family was based.

While assisting a Taiwanese client to purchase an office building in San Francisco he met Walter Shorsenstein. At the time Shorenstein was putting together a syndicate to buy the San Francisco Giants baseball team franchise to keep it from moving to Tampa Bay.

The Giants were a loss making, perennial underperforming team that had not won a MLB championship in 4 decades between 1954 and 1992, and none since it had relocated from New York in 1958. It’s stadium was Candlestick Park, the home for the Giants since it was completed in 1960. However, the stadium was infamous for the windy conditions, damp air and dew from fog, and chilly temperatures. The wind often made it difficult for outfielders trying to catch fly balls, as well as for fans, while the damp grass further complicated play for outfielders who had to play in cold, wet shoes. Hall of famer Willie Mays famously said that the swirly windy conditions at Candlestick cost him 100 home runs.

In 1970 it was astro-turfed so that the San Francisco 49ers could play NFL football games there in the winter and the accompanying renovations did nothing to resolve the poor conditions for baseball games.

Walter Shorsentein wanted to buy the Giants and relocate it away from Candlestick Park to a new location in downtown San Francisco and was putting together a consortium at the time he met Philip in 1992. Shorsentein asked him if he was a Giants fan and despite being a lifelong New York Yankee’s fan, Philip said “yes!” and he wanted to be part of the Giants consortium. Shorenstein agreed to cut him in by rolling his commission on the sale of the office building into the syndicate, plus a deferred payment over 2 years for the balance of his LP interest of $2m. The Shorsentein consortium successfully completed the purchase in 1993.

Philip’s own partnership role in the consortium was delayed as he was not a US citizen and his real estate dealings with Stanley Ho came under scrutiny from the MLB commissioner. However, he was ultimately approved in 1994 as the first, and to this date, the only non-US citizen (and only Portuguese citizen) to be an owner of a MLB franchise. He had completed his dream investment as part-owner of a major league baseball team!

In the ensuing 8-9 years Philip thought that his investment was the biggest mistake of his life. The franchise bled US$20-25m per annum. He and the other 19 limited partners were subjected to annual capital calls to fund the losses. The Giants were barely attracting crowds of 15,000 per game to fill the 63,000 seat stadium at Candlestick Park and the team was plagued with bad luck despite recruiting all stars like Barry Bonds in 1993. Bonds himself was a key figure in Bay Area Laboratory Co-operative (BALCO) anabolic steroids drugs scandal that created more controversy around the Giants.

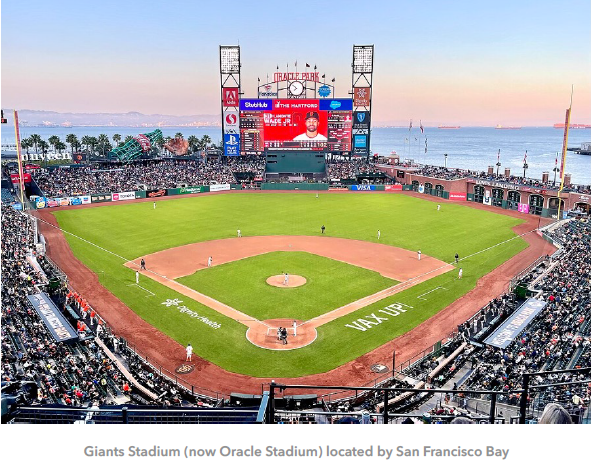

The one ray of light for the Giants was the new stadium being developed in South Beach bordering the Embarcadero port district of San Francisco city, that was being gentrified by the city council. Approved in 1996, the stadium was state of the art, with full corporate, F&B and entertainment facilities with capacity for 40,000 fans. It was also in a unique location unlike any other stadium, located right by the water on San Francisco bay.

It was a huge hit with sponsors and fans, with the equity value covered from the sale of the stadium rights and seat sales. When it opened in April 2000, the seats were packed and the stadium started to make money. Within 5 years the bank loans had been fully repaid. Besides baseball it became a multi-event destination for music concerts, the AMA Supercross championships, Monster Jam, rugby 7s, college football and international soccer.

The Giants franchise became even more profitable when it negotiated the sale of its own television station rights to Comcast and FOX for US$350m. Philips passion investment in a MLB baseball team after more than a decade and a half of pain, was repaying itself in spades.

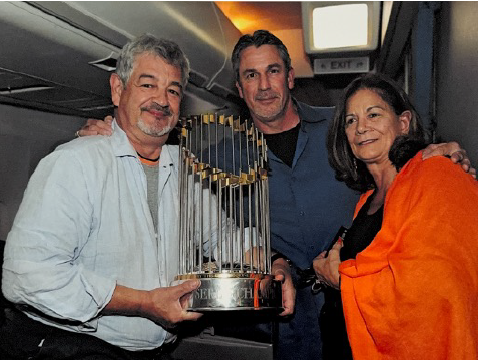

Even better was to come with success on the field and the Giants started to win championships. World Series Champions in 2010, 2012 and 2014, the baseball team led by their inspirational catcher “Buster” Posey who was MVP in two of those years (2010, 2012). Philip watched every playoff game live, following his team to each heart stopping game, sharing the players, coaches and support teams highs and lows from inside the locker room. It was a dream he could never have imagined growing up as a young baseball fan in Hong Kong.

His Giants investment was always so much more than just financial gain and it had provided him with irreplicable lifelong experiences in the sport that he loved.

The Giants were an enormous financial success and more to come as the franchise developed the real estate around the stadium. The entire South Bay district has now become an entertainment and business district with the development of the nearby Chase Centre (Home of the Golden State Warrior) and the global headquarters of many leading tech companies.

Back in Hong Kong Philip kept investing in real estate. In 1996 he founded Shama apartments one of Hong Kong’s first service apartment chains. It was a new concept in the city accustomed to either short stay hotels or long stay apartments and proved extremely popular with expatriates seeking convenience of fully furnished quality accommodation with concierge and maid services . He grew the business until he sold it to Morgan Stanley in 2006.

Once his non-compete expired, he went back to the serviced apartment business founding Chi Residences that continues to operate to this day under his children’s management.

Philip continues to look for new opportunities and his entrepreneurial spirits have not diminished . He has interests in a number of restaurants such as Paper Moon and California Pizza Kitchen in Hong Kong and Manila, as well as the Garden Island resort in Fiji.

He has always been willing to give back to the community and is currently chairing the development a new club in Subic Bay, Manila with the former Fleet Arcade membership, for navy servicemen from around the world as well as the general public. He remains a Trustee of the Club Lusitano joining at the age of 18 and remembers being introduced to the club by Meno Baptista and approved by Sonny Sales. He is also a Governor of the Portuguese Community Welfare and Education Foundation.

His Giants ownership remains his pride and joy and while another championship has yet to materialise, his investment continues to grow in value. Forbes magazine most recently estimated the San Francisco Giants to be the 5th most valuable Major League Baseball franchise valued at US$4 billion, behind only the Chicago Cubs, Boston Red Sox, Los Angeles Dodgers and his beloved New York Yankees.